Key Takeaways:

Low CPMs signal you're reaching audiences other advertisers don't value—usually low-intent, discount-only buyers

These subscribers contaminate your database, skewing A/B tests, training algorithms wrong, and hurting deliverability

Dashboards hide the damage: your ICP segment may be performing well while low-quality subscribers drag down averages

The fix requires connecting acquisition source to lifecycle performance and creating quality-adjusted metrics

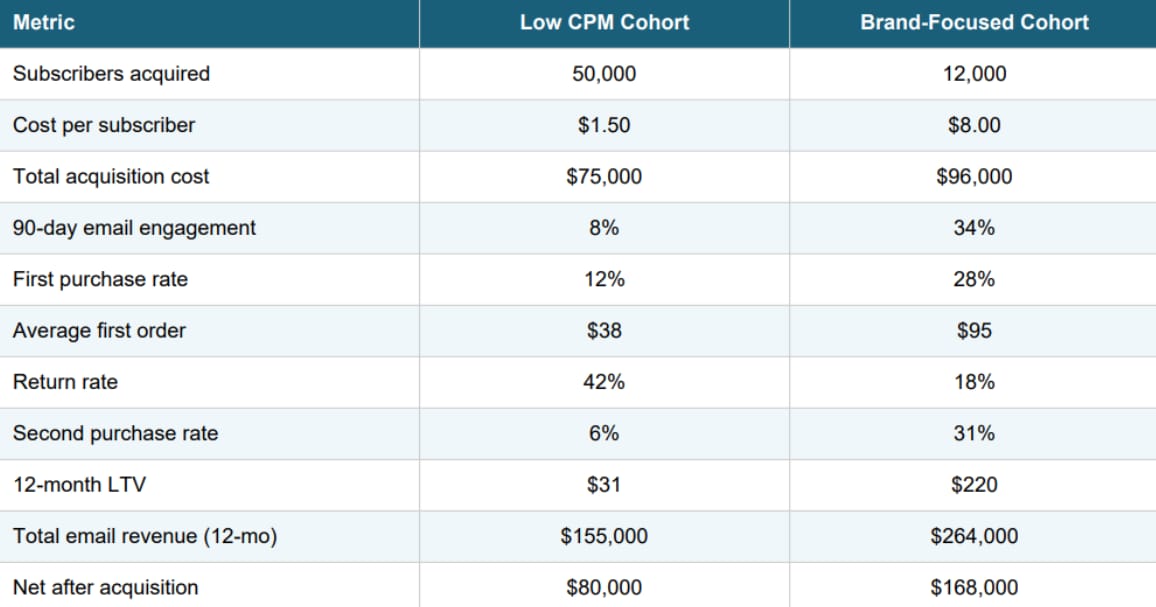

Brand-focused cohorts typically generate 2x the profit from 1/4 the subscribers compared to low CPM cohorts

Key Definitions

CPM (Cost Per Mille): The cost to deliver 1,000 ad impressions. Lower CPM means cheaper reach—but not necessarily better customers.

LTV (Customer Lifetime Value): Total revenue a customer generates over their relationship with your brand, minus costs to serve them.

ICP (Ideal Customer Profile): The characteristics of customers who generate the most value—typically full-price buyers with high repeat rates and low returns.

Owned Channels: Marketing channels you control directly—email, SMS, push notifications, app messaging—where you don't pay per impression.

Quality-Adjusted Email Revenue: Revenue from subscribers acquired through ICP-focused campaigns, excluding first-purchase discount revenue.

The Pattern I Keep Seeing

Let me describe a pattern I've seen destroy owned channel performance at dozens of apparel brands.

The marketing team reports strong acquisition numbers. Email list is growing 15-20% monthly. The paid media team is celebrating low CPMs and efficient spend. Everything looks good on the dashboard.

Six months later, open rates have cratered. Click rates are worse. Revenue per send is down 30%. The SMS program that was printing money now barely breaks even. The retention team is blamed. New tools are purchased. Subject lines are tested endlessly. Nothing works.

The problem was never retention.

The problem was that acquisition had been quietly poisoning the database for months, and by the time the symptoms appeared, the damage was structural.

The First Why: Understanding the Surface Problem

When owned channel performance degrades, most teams reach for tactical explanations. The creative is stale. Send frequency is wrong. Segmentation needs work. These explanations are comfortable because they suggest tactical fixes.

But consider what's actually happening in most apparel brands chasing low CPM acquisition. Your email list is growing. Yet revenue per subscriber is declining. Open rates are dropping. Click rates are dropping faster. The only emails that perform are deep discount promotions.

The typical response is to optimize harder—better subject lines, smarter send times, more sophisticated flows. This is the equivalent of rearranging deck chairs.

The actual diagnosis: You're not facing a messaging problem. You're facing a database composition problem. Every low-quality subscriber acquired through cheap CPM campaigns is now diluting your metrics, skewing your tests, and training your algorithms on the wrong signals.

The Second Why: The Contamination Mechanism

To understand why low CPM acquisition specifically damages owned channels, you need to follow a subscriber through their entire lifecycle.

Day Zero: Acquisition

The subscriber clicked on a polarizing ad—the kind that performs well at low CPMs because it appeals broadly to audiences other advertisers ignore. They signed up for a 20% discount. They never intended to become a customer. They wanted the deal.

Days 1-30: The False Signal

The new subscriber opens your welcome series. They click around. Your engagement metrics spike. But look closer. They're not buying at full price. They're waiting. Scanning subject lines for "SALE" and "% OFF." When they do purchase, it's the lowest-margin item during a promotion. Return rate: 40%.

Days 30-90: The Training Problem

Now something insidious happens. Your email platform's algorithms are learning. Send time optimization starts skewing toward when low-quality subscribers engage. Your A/B tests are increasingly decided by audiences who only respond to discounts. This isn't insight. This is contamination.

Day 90+: The Drag

The subscriber goes dormant. They're hurting your deliverability scores. Gmail is watching. Inbox placement for your real customers starts slipping. Eventually they mark you as spam. But by then, you've paid to acquire them, paid to email them for months, paid in deliverability damage, and received almost nothing in return.

The Decision-Making Corruption

This is where the damage extends beyond channel performance into strategic distortion.

The information asymmetry is complete. Leadership is making rational decisions based on data that doesn't reflect reality.

Cohort Comparison: The Math That Changes Everything

The brand-focused cohort generated 2x the profit from one-quarter the subscribers. This is not a marginal difference. This is a fundamentally different business.

The Framework: Diagnosis and Correction

Step 1: Segment by Acquisition Source

Build a view connecting every subscriber to their acquisition campaign. Track: acquisition source, first purchase (yes/no), return rate, 12-month LTV, engagement score.

Step 2: Create Quality-Adjusted Metrics

Formula: Quality-Adjusted Email Revenue = Revenue from ICP-sourced subscribers − First-purchase discount revenue

Step 3: Run the Cohort Analysis

Compare lowest CPM campaigns against brand-focused campaigns over 6-month window. Measure engagement, purchase rate, return rate, and LTV.

Step 4: Restructure Reporting

Replace vanity metrics (list size, total revenue) with quality indicators (ICP subscribers, engaged %, revenue by segment, projected LTV).

Role-Specific Guidance

For Retention Managers

Stop trying to save everyone. Identify poisoned segments (low CPM + <5% engagement after 90 days). Quarantine rather than nurture. Change metrics to revenue per engaged subscriber. Push back with data: "Every 10,000 low-quality subscribers costs X in deliverability damage."

For CMOs

Redefine "working." Require 90-day cohort analysis before scaling any campaign. Set quality floors. Change the CEO conversation from "We added 50,000 subscribers" to "We added 8,000 high-value subscribers projected to generate $1.4M."

For CEOs

This is strategic positioning, not channel optimization. Ask: "If we stopped discounting tomorrow, what % of our list would purchase again?" Run the Temu test: Can you compete on discounts? No. So why acquire customers who only respond to discounts?

Frequently Asked Questions

Why is my email open rate declining even though my list is growing?

Growing lists often include low-quality subscribers from cheap CPM campaigns. Your ICP segment may have stable or improving rates—the decline is from low-intent subscribers diluting the average.

Does low CPM always mean bad audience quality?

Usually, yes. Low CPMs indicate you're reaching audiences other advertisers don't value. Meta finds cheap impressions by targeting low purchase intent users. For broad apparel acquisition, low CPM almost always correlates with low customer quality.

How do I calculate quality-adjusted email revenue?

Quality-adjusted email revenue = Revenue from ICP-sourced subscribers − First-purchase discount revenue. Requires connecting email platform to acquisition source data.

What's a good email subscriber LTV by acquisition source?

In apparel: Low CPM cohorts typically show 12-month LTV of $25-40. Brand-focused cohorts show $150-250. A 5-7x difference between cohorts indicates significant acquisition quality problems.

The Fundamental Reframe

Would you rather spend $100 on a customer that brings $200 in profit, or $50 on a customer that brings $50 in profit?

The $50 customer: Buys $80 on sale, returns $30, never repurchases. Net: negative $10.

The $100 customer: Buys $150 at full price, keeps everything, purchases 3x/year. Three-year value: $800+.

Your owned channels are where this math plays out. Every subscriber is either an asset generating compounding returns or a liability generating compounding costs.

Low CPM acquisition systematically fills your database with liabilities while making it appear you're accumulating assets.

The correction starts with seeing clearly.